The City of Angels is an amazing place to live and a great option to invest and grow your wealth.

If you are looking to benefit from historical appreciation, future growth potential, and a robust economy, Los Angeles real estate investing is an excellent venture.

But, like any type of investment, investing in real estate in Los Angeles has its pros and cons. Read on to gain an in-depth insight into the city’s real estate.

Credit: Image by Denys Nevozhai | Unsplash

Understanding Los Angeles Real Estate Market

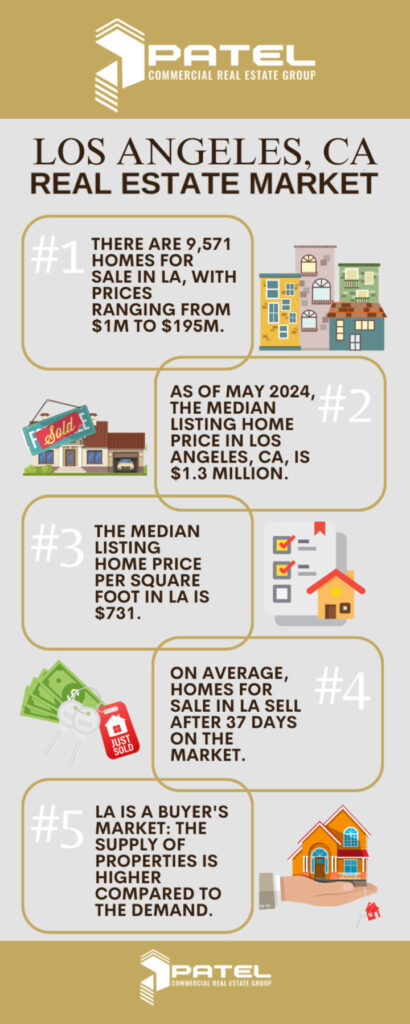

Los Angeles consists of 107 neighborhoods. The most recent data shows there are 9,571 homes for sale, with prices ranging from $1 million to $195 million.

As of May 2024, the median listing home price in Los Angeles, CA, is $1.3 million. This is slightly higher compared to the previous year, at a 2.1% year-over-year increase. The median listing home price per square foot in LA is $731. The median home sold price is $1.3 million.

A significant information for Los Angeles real estate investors: In May 2024, Los Angeles, CA, is a buyer’s market. This means that the supply of properties is higher compared to the demand for homes.

On average, homes for sale in Los Angeles, CA, sell after 37 days on the market.

Advantages of Investing

Investing in Los Angeles, CA, residential real estate can prove to be a profitable venture because of the city’s potential for generating steady cash flow, tax benefits, and appreciation.

1. High Demand for Rental Properties

With the high occupancy rates and the ability to charge premium rent in Los Angeles’ top neighborhoods, investing in properties in Los Angeles, CA, promises steady cash flow and a good return on investment.

Universities in the area, like UCLA and USC, and industries that draw young professionals drive a continuous need for residential rentals.

Credit: Image by Drew Dau | Unsplash

2. Strong Economic Base

Home to numerous Fortune 500 companies and boasting a thriving startup scene, Los Angeles is a powerhouse of economic activity.

Major projects like the expansion of public transportation and revitalization of downtown Los Angeles are some of the city’s ongoing developments that will enhance property values further.

LA’s economic stability, along with attractive property values and high rental demand, makes this city a sound investment location.

Credit: Image by Sherman Yang | Unsplash

3. Tourism and Entertainment Industry

Los Angeles is a global hub for entertainment and media. Home to Hollywood, LA attracts millions of tourists every year. This is a significant factor in the city’s flourishing real estate industry.

Real estate investors can greatly benefit from short-term rental properties, such as Airbnb, which can generate substantial returns from this inflow of tourists.

4. Appreciation Potential

Investing in Los Angeles shows great potential for significant capital gains over time.

Historically, real estate properties in this location have shown strong long-term appreciation, mainly due to the city’s ongoing development, increasing population, and limited housing supply.

From November 2018 through November 2023, the median home price in LA has grown by 46%. This is an average appreciation rate of 9.2% per year.

Credit: Image by Leo_Visions | Unsplash

5. Diverse Neighborhoods

The diverse Los Angeles real estate market boasts a wide range of properties, from luxury beachfront residences to trendy lofts. This allows investors to choose from a variety of options that align with their investment goals and risk tolerance.

6. Tax Benefits and Incentives

Real estate investing in Los Angeles also comes with tax benefits and the potential for passive cash flow and/or appreciation.

Tax benefits from residential investments in LA include deductions for mortgage interest, property taxes, and depreciation. These can significantly improve the profitability of your investments.

Challenges of Investing

Like any investment, Los Angeles real estate also entails risks. This section enumerates some of the challenges to expect when you’re investing in LA.

Credit: Image by Peter Thomas | Unsplash

1. High Property Prices

The high values of Los Angeles real estate may be advantageous for those who already own property, but this creates a hurdle for buyers.

One way to get around this challenge is with crowdfunding. Real estate crowdfunding allows several investors to pool funds to purchase a property, so they share in the financial responsibility.

2. Regulatory Environment

When investing in real estate in Los Angeles, investors should be aware of environmental regulations and legislation, as compliance could impact both the cost and value of a property.

Los Angeles has a complex regulatory environment, and navigating this can pose a challenge for real estate investors. The city has various zoning and building codes that must be followed, which adds both time and cost to the investment process.

Credit: Image by Himmel S | Unsplash

3. Natural Disasters and Environmental Concerns

Important factors that are crucial in contributing to a sustainable real estate market in Los Angeles include:

Soil and Air Quality

Air and soil pollution in Los Angeles influence the long-term appreciation potential of the properties.

Water Scarcity

Recurring drought problems and water scarcity in LA can adversely affect property values.

Natural Disasters

Natural disasters are environmental considerations that can significantly affect property values. In Los Angeles, proximity to wildfires and earthquakes may have a negative impact on the value of a property.

Energy Efficiency

Homes that feature energy-saving technologies are becoming more popular in Los Angeles because of their environmental benefits and cost savings. This can command higher prices and rent rates.

4. Market Volatility

The Los Angeles real estate market is known for its volatility, with periodic booms and slumps.

While one of the advantages of the LA real estate market is the high property values, there have been sporadic fluctuations since the COVID-19 pandemic. Initially, the lockdown led to a decline in sales. This was followed by a surge in demand after the lockdown, resulting in an increase in property prices.

5. High Competition

The intense competition among buyers and investors can make it challenging for investors to secure desirable properties in Los Angeles. This can also result in more aggressive investment strategies with the potential for higher returns but also pose higher levels of risk.

6. Financing and Mortgage Challenges

Interest rates in Los Angeles, CA, have been increasing since early 2022. This uptrend not only affects monthly mortgage payments, but it also entails broader implications for the city’s real estate market.

With higher interest rates, borrowing becomes more costly, and the potential profitability for investors can decrease, especially for those who rely heavily on loans.

Conclusion

Despite the cons, investing in Los Angeles real estate is definitely a strategic move with great potential for financial growth.

If you want to learn more about investing on the top real estate properties in Los Angeles, CA, give me a call today at (213) 453-2572 or send me an email at realtorjackpatel@gmail.com to schedule an appointment.

Frequently Asked Questions

What are the main advantages of investing in Los Angeles real estate?

The main advantages of investing in Los Angeles real estate include high demand for rental properties, a strong economic base, a tourism and entertainment industry, appreciation potential, diverse neighborhoods, and tax benefits and incentives.

What challenges should investors know when investing in Los Angeles real estate?

The challenges in investing in Los Angeles real estate include high property prices, regulatory environment, natural disasters and environmental concerns, market volatility, high competition, and financing and mortgage challenges.

Is Los Angeles real estate still a good investment despite high property prices?

Yes, definitely! Despite the challenges, investing in Los Angeles real estate is a sound decision with great potential for financial growth.