Photo by Binyamin Mellish

You’ve found the perfect property in Southern California, but before you can call it home, remember to factor in the often-overlooked expense that can add thousands of dollars to your final bill: closing costs.

Closing costs are the expenses associated with the final stages of a real estate transaction. In California, homebuyers can expect to pay a range of fees at closing, including lender fees, appraisal fees, title fees, and more.

The closing costs can vary greatly depending on the loan type, property value, and other factors. As a result, homebuyers and sellers must understand what closing costs are and why they are necessary.

In this article, we will discuss what are the closing costs on a typical house in California, guide you through the closing cost process, and provide tips on preparing for these expenses and potentially saving money on your next real estate transaction.

Why are Closing Costs Necessary?

Photo by Alexander Grey on Unsplash

In Southern California, closing costs can be high and should not be overlooked by homebuyers and sellers. Here are some reasons why knowing closing costs is important:

Higher Home Values

Photo by todd kent on Unsplash

Southern California is known for its high home values, which means the closing costs will also be higher. This can be a significant expense for homebuyers, especially if they are already stretched from the down payment and other home-buying fees. Thus, knowing your closing costs can help you prepare financially for your home purchase.

Negotiation

Photo by Sebastian Herrmann on Unsplash

Closing costs can be a negotiation point between buyers and sellers. In Southern California, where the real estate market can be competitive, negotiating closing costs can help buyers and sellers save money.

Knowing what closing costs are can be helpful when you want to negotiate with the other party in a real estate transaction. Utilize this to your advantage when negotiating the final price.

Legal Requirements

Photo by Gabrielle Henderson on Unsplash

In California, specific legal requirements must be met during a real estate transaction, and some of these requirements can incur fees. For example, a title search must be performed to ensure no liens on the property, which can come with a price.

To avoid potential inconvenience, it is essential to be aware of the closing costs associated with any legal transaction.

Average Closing Costs in California for Homebuyers

Photo by Tierra Mallorca on Unsplash

Knowing the average closing costs in California as a buyer is essential when purchasing a home. These costs can vary depending on the location, type of property being purchased, and other factors.

When you buy a home in Southern California or refinance an existing one, you will typically encounter closing costs associated with obtaining a mortgage loan. These costs include loan origination fees, appraisal fees, title and escrow fees, attorney fees, and discount points.

On average, home buyers in Southern California can expect closing costs to range between 2% and 5% of the purchase price. For example, the median home price in California in early 2023 was approximately $775,000, meaning closing costs for such a purchase could fall between $15,500 and $38,750. However, remember that this is only an estimate, and your closing costs may differ based on different variables.

Closing costs can be higher for more expensive properties and lower for more affordable homes. Other factors, such as the lender’s requirements, the property location, and the type of loan, can also affect the total closing costs.

Awareness of these variables can help potential home buyers make informed decisions about their mortgage loans and budget their finances accordingly.

Who Pays the Closing Cost in Southern California?

Photo by Kostiantyn Li on Unsplash

In Southern California, as with many other parts of the United States, the party responsible for paying closing costs can vary depending on the terms of the sale agreement and the negotiations between the buyer and seller.

Traditionally, the buyer is responsible for paying most of the closing costs in a real estate transaction. The typical costs shouldered by the buyer include home inspections, appraisals, title insurance, and loan origination fees.

However, some sellers may be willing to cover some or all of these costs to close the deal. It is important to note that closing costs can add up to several thousand dollars. Hence, buyers and sellers must clearly understand who will pay these costs before finalizing the sale.

A real estate agent can assist and guide you through the entire real estate process and answer any questions you may have regarding closing costs.

Breaking Down and Understanding the Closing Costs

Photo by Maria Ziegler on Unsplash

So what are the closing costs on a house in California that are typically included when purchasing or selling a home? Let’s have a peek at some of the typical closing costs for homebuyers and sellers.

Let’s first start with the closing cost included when purchasing a home. As a homebuyer, you might not have to pay for some of these costs depending on your county, the type of loan you use, and other factors. This generalized list includes some of California’s more common fees for home buyers:

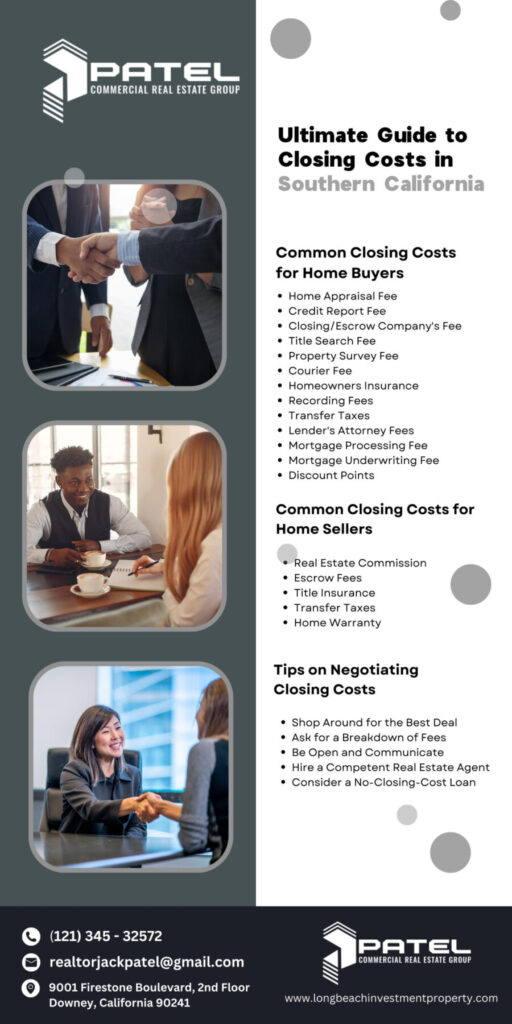

Common Closing Costs for Home Buyers

Photo by LinkedIn Sales Solutions on Unsplash

Home Appraisal Fee

This fee covers the cost of a professional property appraisal to determine its market value. The payment can range from $300 to $500, depending on the complexity of the assessment. The lender typically requires the appraisal to ensure the property is worth the loan amount.

Credit Report Fee

This fee is associated with the cost of obtaining a credit report for the borrower. The lender uses the credit report to assess the borrower’s credibility and capacity to repay the loan. Credit Report Fee can range between $25 and $50.

Closing/Escrow Company's Fee

This fee refers to the cost of the closing/escrow company’s services, which include coordinating the various aspects of the closing process, such as preparing documents, collecting and disbursing funds, and recording the transfer of ownership. Buyers can expect to pay closing/escrow company fees between $500 and $1,000.

Title Search Fee

This fee encompasses the cost of a title search to ensure that the property has a clear title and that there are no existing liens or other encumbrances on the property, which can range from $400 to $600.

Property Survey Fee

This refers to the cost of a professional survey of the property to determine its boundaries and identify any encroachments or other issues that may affect its value or use. Property Survey Fee can vary widely depending on the size and complexity of the property being surveyed but typically falls between $400 and $700.

Courier Fee

The courier fee is usually around $50. It covers the cost of sending documents and other materials between the parties involved in the closing process, such as the lender, the title company, and the closing/escrow company.

Homeowners Insurance

This encompasses the cost to protect the property and the borrower’s investment. The cost of homeowners insurance will vary on factors such as the location and value of the home, but it is typically around 0.25% to 0.5% of the home’s value. At closing, buyers will generally pay the first year’s premium upfront.

Recording Fees

Recording Fees refer to costs associated with recording the transfer of ownership and other documents with the county recorder’s office. In Southern California, recording fees can range from $50 to $100.

Transfer Taxes

In Southern California, transfer taxes are typically paid by the home buyer when the property title is transferred from the seller to the buyer. Transfer taxes can vary depending on the property’s location and market value.

Lender's Attorney Fees

The home buyer pays Lender’s attorney fees to cover the cost of the attorney representing the lender during the home-buying process. This cost can vary depending on the lender and the complexity of the transaction and typically costs between $500 and $1,000.

Mortgage Processing Fee

The lender charges Mortgage Processing Fee to cover the cost of processing the mortgage application. It typically includes administrative costs such as document preparation, credit checks, and appraisal fees and usually costs around $500 to $1,000.

Mortgage Underwriting Fee

Underwriting is the process of evaluating the borrower’s creditworthiness and determining whether they meet the lender’s criteria for a mortgage. Mortgage Underwriting Fees can range from $500 to $1,000.

Discount Points

Discount points are optional fees that home buyers can pay to reduce the interest rate on their mortgage. Buyers can pay discounts upfront to secure a lower mortgage rate.

Each discount point equals 1% of the loan amount and often reduces the interest rate by 0.25%. The cost of discount points can vary depending on the lender and the mortgage terms, but they generally are around 1% of the loan amount.

So now, how about the sellers? Closing costs in California for a seller can be affected by various factors, including the sale price of the property, the terms of the sale, and the property’s specific location.

Generally, closing costs for selling a home in Southern California can range from 6% to 10% of the sale price. However, it is essential to note that these costs are estimates and can vary based on the particular circumstances of the sale.

It is recommended that sellers consult with a real estate agent or real estate attorney to understand their potential closing costs better. Here are some of the typical closing costs for sellers in Southern California:

Common Closing Costs for Home Sellers

Photo by Austin Distel on Unsplash

Real Estate Commission

This is the commission paid to the real estate agents involved in the sale, typically ranging from 5% to 6% of the sale price.

Escrow Fees

The escrow company charges for handling the transaction are usually around 1% of the sale price.

Title Insurance

This is the cost of purchasing title insurance to protect the buyer against property title issues, typically around 0.5% to 1% of the sale price.

Transfer Taxes

Some cities and counties in Southern California may charge a transfer tax on a real estate deal, which can vary from 0.1% to 2.5% of the sale price.

Home Warranty

Some sellers may offer a home warranty to the buyer as part of the sale, typically costing around $500 to $700.

Negotiating Closing Costs

Photo by Amy Hirschi on Unsplash

Negotiating closing costs in Southern California can be a smart move for home buyers looking to save money. Here are some useful tips to guide you on how you can negotiate your closing costs if you find yourself in a real estate transaction:

Shop Around for the Best Deal

The first step to negotiating closing costs is shopping for the best deal. Get quotes from multiple lenders and compare their closing cost estimates. This will give you an idea of what you can expect to pay and which lender to choose for you to save money.

Ask for a Breakdown of Fees

Once you have chosen a lender, ask them for a breakdown of all the fees associated with your loan. This will help you identify closing costs that may seem excessive or unnecessary.

Be Open and Communicate

Armed with the knowledge of the costs associated with your loan, be open and communicate with your lender to reduce or eliminate fees you feel are unreasonable. For example, you can negotiate a lower origination, appraisal, or title insurance fee.

Hire a Competent Real Estate Agent

An excellent real estate agent can help you negotiate closing costs. They can use their experience and knowledge of the local market to help you get a better deal.

Consider a No-Closing-Cost Loan

Some lenders offer no-closing-cost loans, meaning they will waive some or all of the fees associated with your loan in exchange for a higher interest rate, which can be a good option if you don’t have the cash upfront to pay for closing costs.

Remember that negotiations can vary depending on the current real estate market conditions and the seller’s willingness to negotiate. It is also essential to read and understand the contract terms before signing to ensure that all parties clearly outline and agree upon any negotiated fees.

Wrap Up

There are various costs associated with buying or selling a home in Southern California, which we call closing costs. In Southern California, homebuyers and sellers will likely face higher closing costs due to the region’s high home values, complex transactions, negotiation requirements, and legal obligations.

Therefore, it is essential to understand closing costs, why they are necessary, how to prepare financially, and negotiate with another party involved in a real estate deal. In a competitive real estate market like Southern California, negotiating closing costs can help buyers and sellers save money.

Please feel free to get in touch and call me at (213) 453-2572 or send me a message at realtorjackpatel@gmail.com if you have any questions regarding closing costs in Southern California.

To stay up-to-date on the latest news and updates about the area, we encourage you to follow us on our social media platforms:

Photo by Zac Gudakov on Unsplash

Frequently Asked Questions

What are closing costs?

Fees related to the final stages of a real estate transaction are called closing costs and can include lender fees, appraisal fees, title fees, and more.

How much are closing costs in Southern California?

Closing costs in Southern California range between 2% and 5% of the purchase price. For instance, if you bought a home for $800,000, expect to pay $16,000 to $24,000 closing costs.

What are some typical closing costs in Southern California?

Various closing costs are associated with buying or selling a property in Southern California. Some of the most common expenses include the appraisal fee, escrow fees, title insurance, home inspection fees, property taxes, recording fees, and real estate commissions.

Can closing costs be negotiated?

Yes, closing costs in Southern California can be negotiated between the buyer and the seller. Typically, closing costs can be around 2% to 5% of the home’s purchase price, so it’s worth considering negotiating these fees to help reduce the overall cost of the transaction.

Who pays for closing costs in Southern California?

In Southern California, the responsibility for paying closing costs can vary depending on the purchase contract terms and local customs. Generally, the homebuyer is responsible for paying most of the closing costs, but since closing costs can be negotiated, the seller may agree to pay some fees.